Employment Datasheet

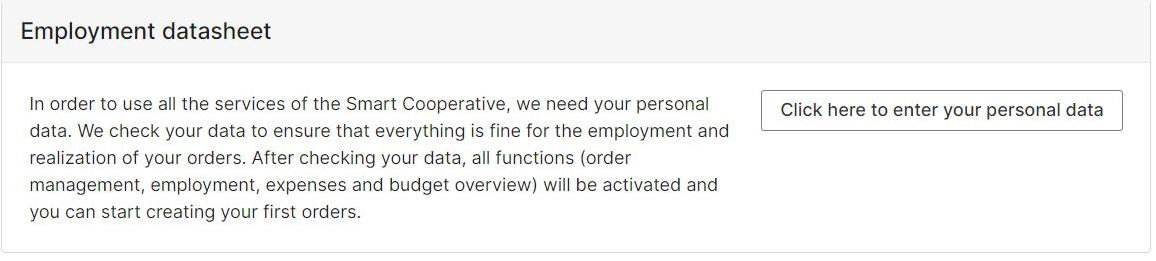

Once your membership has been activated in the Smart Portal, you will be asked to complete the employment data sheet. You'll be required to enter important employment-related data to start your contract. After completion of this form you'll be able to use other functions of the portal, such as creating your first order.

Please note that the personal details from the employment data sheet will have an impact on your payroll processing.

You will be lead step by step through the questionnaire here:

Personal Details

For legal reasons, we have to ask for your gender. Please enter your official gender as it appears on your identity card or travel document in the Gender field. If you use pronouns other than those on your ID card, you can specify your preference under Pronouns. You can also select 'Name' if you prefer to be addressed without pronouns.

Residence Permit

If you are not an EU citizen, you will most likely need a residence permit to work in Germany. We are therefore obliged to ask for this document.

With Smart you will have the status of an employee, so you will need to demonstrate a residence permit allowing full access to the labor market (note 'Erwebstätigkeit gestattet'). Visa for self-employment purpose (AufenthG § 21) is unfortunately not sufficient.

Please note that the information on access to the labor market is usually on the back of the residence permit, so we need both sides.

Marital status and tax class

We need this information for correct payroll processing. You can find your tax class on your previous income tax assessment notice (Lohnsteuerbescheid), on your income statement (Einkommensbescheid) or on your payslip (Lohnbeleg). If you have any questions, please contact your local tax office.

The Tax Identification Number

The tax identification number is an eleven-digit identification number that every citizen registered in Germany receives for tax purposes when they are born or when they first register in Germany.

You received the number in a letter from the Federal Central Tax Office. If you cannot find the letter, look for it on your income tax statement or on your last income tax assessment notice, or contact your local tax office.

If you have lost the letter or never received it, you can apply for the number to be reassigned here.

Please note: the tax identification number (Steueridentifikationsnummer) should not be confused with the tax number (Steuernummer), which you have to apply for separately to register your self-employed activity. If you process all your invoices via Smart and are not also self-employed, you do not need to apply for a tax number.

Health Insurance

While employed by Smart, you must register with a public health insurance provider. If you are already a member of a public health insurance provider, you just need to let us know which one, so we can forward your contributions there. It is up to you which health insurance provider (Krankenkasse) you choose.

If you do not have public health insurance yet, you can compare different providers via our partner Feather and register for one directly here.

Type of health insurance

Please note: As an employee in Germany you are obliged to be insured through the public health insurance. There is an exception for employees who earn more than 66.600 EUR gross per year (as of 2023). If that applies to you, you can alternatively opt for private insurance.

No Comments