Payroll

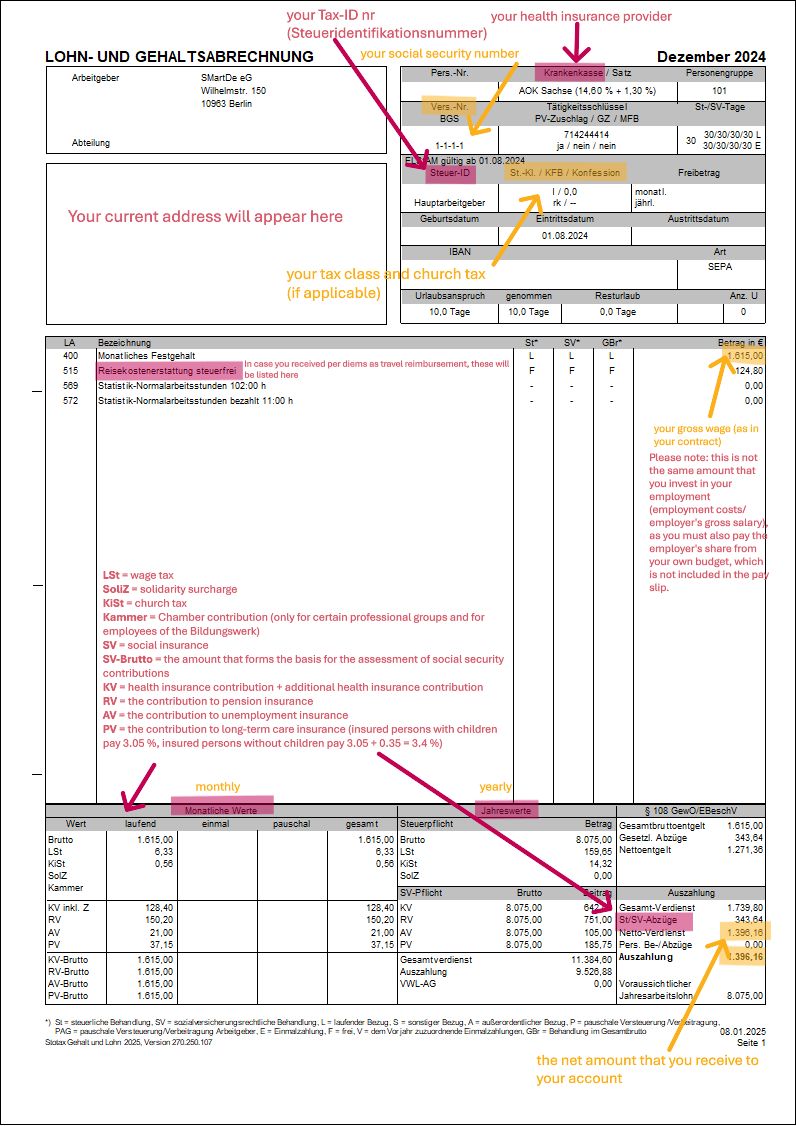

If you are employed via Smart, you will receive an automatically generated payslip ("Lohnzettel", "Lohnbeleg") at the beginning of the following month, which is uploaded to the Mein.Smart portal. The payslip summarizes all the information about your employment.

The payslip is an important document and official proof of your income. You will receive it every month per e-mail and additionally you can indfind it in your Mein.Smart account.

Payslip

On the payslip there are only the employee's shares (50%) visible. If you are employed via Smart, you must also pay the employer's share (the other 50%) from your budget. However, this is not listed on the payslip. You can see the full costs in your budget, and an orientation in the employment categories table.

Income tax statement

The Lohnsteuerbescheinigung is an income tax certificate that you receive for a full calendar year. It shows all contributions that you have paid that year. You will find this document in you Mein.Smart as well at the beginning of the following year. You might need this document for your tax declaration.

Please

note Salary

Thisthat there is yourno grossincome employeetax salary.

Pleaseissued note:for thisemployees ison nota thesocial-security samefree amount that you invest in your employment (employment costs/employer's gross salary), as you must also pay the employer's share from your own budget, which is not included in the pay slip.Minijob.

TaxesStatements for the social security

The tax line shows the deducted wage tax and church tax.

Net salary

The "Net salary" line shows the amount you receive from Smart as your salary at the end of the month.

Personal data

The payslip also contains your Sozialversicherungsnummer (SV-Nr.) and your Steuer-Identifikationsnummer (Steuer-ID) - both numbers can be found in the box at the top left.