Payroll

If you are employed via Smart, you will receive an automatically generated payslip ("Lohnzettel", "Lohnbeleg") at the beginning of the following month, which is uploaded to the Mein.Smart portal. The payslip summarizes all the information about your employment.

The payslip is an important document and official proof of your income. You will receive it every month per e-mail and additionally you can find it in your Mein.Smart account.

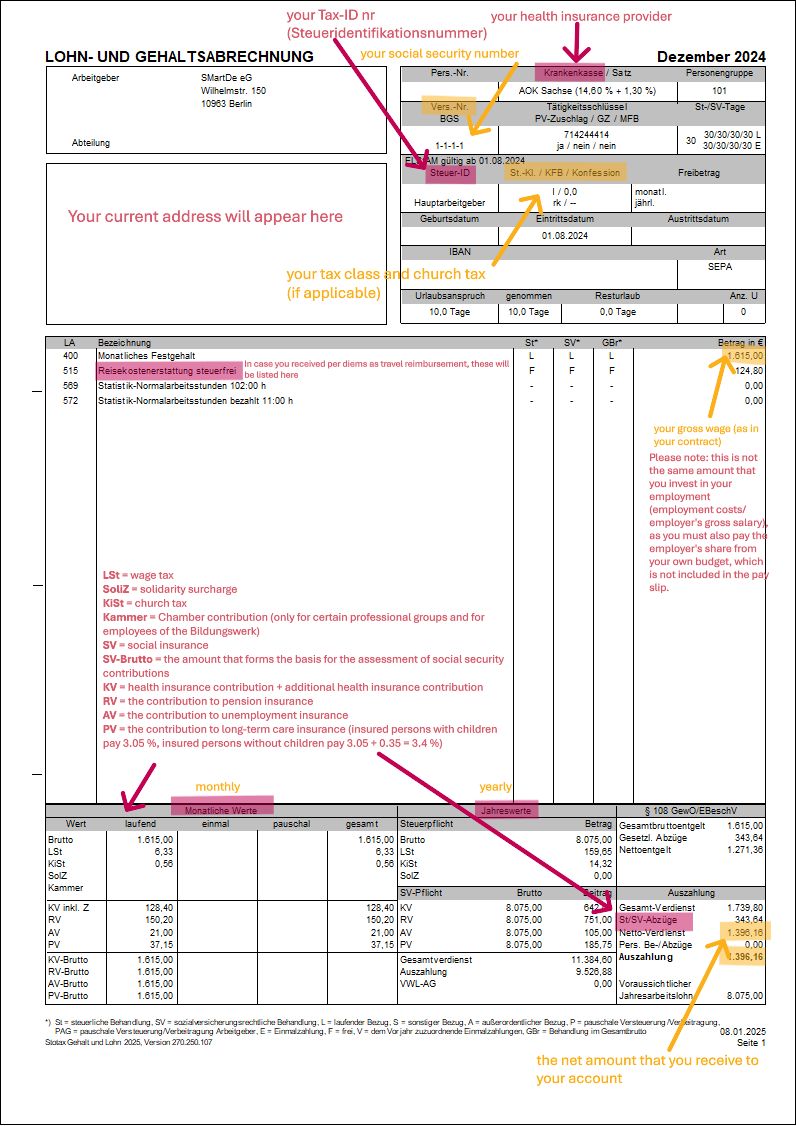

Payslip

On the payslip there are only the employee's shares (50%) visible. If you are employed via Smart, you must also pay the employer's share (the other 50%) from your budget. However, this is not listed on the payslip. You can see the full costs in your budget, and an orientation in the employment categories table.

The social insurance line summarizes the employee shares for health, long-term care, pension and unemployment insurance.

The respective shares are broken down again separately in the box at the bottom left:

LSt = wage tax

SoliZ = solidarity surcharge

KiSt = church tax

Kammer = Chamber contribution (only for certain professional groups and for employees of the Bildungswerk)

SV = social insurance

SV-Brutto = the amount that forms the basis for the assessment of social security contributions

KV = health insurance contribution + additional health insurance contribution

RV = the contribution to pension insurance

AV = the contribution to unemployment insurance

PV = the contribution to long-term care insurance (insured persons with children pay 3.05 %, insured persons without children pay 3.05 + 0.35 = 3.4 %)

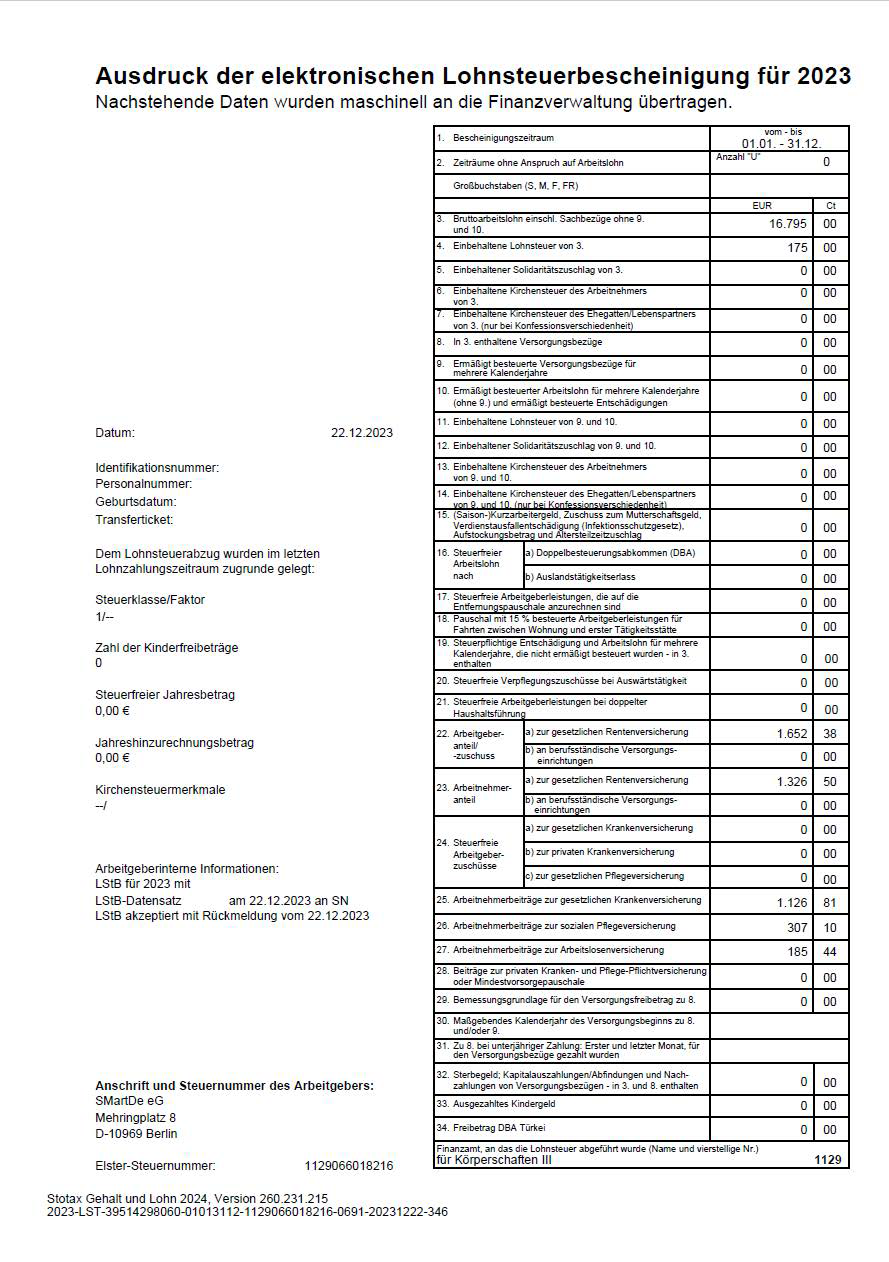

Income tax statement

The Lohnsteuerbescheinigung is an income tax certificate that you receive for a full calendar year. It shows all contributions that you have paid that year. You will find this document in you Mein.Smart as well at the beginning of the following year. You might need this document for your tax declaration.

Please note that there is no income tax certificate issued for employees on a social-security free Minijob.

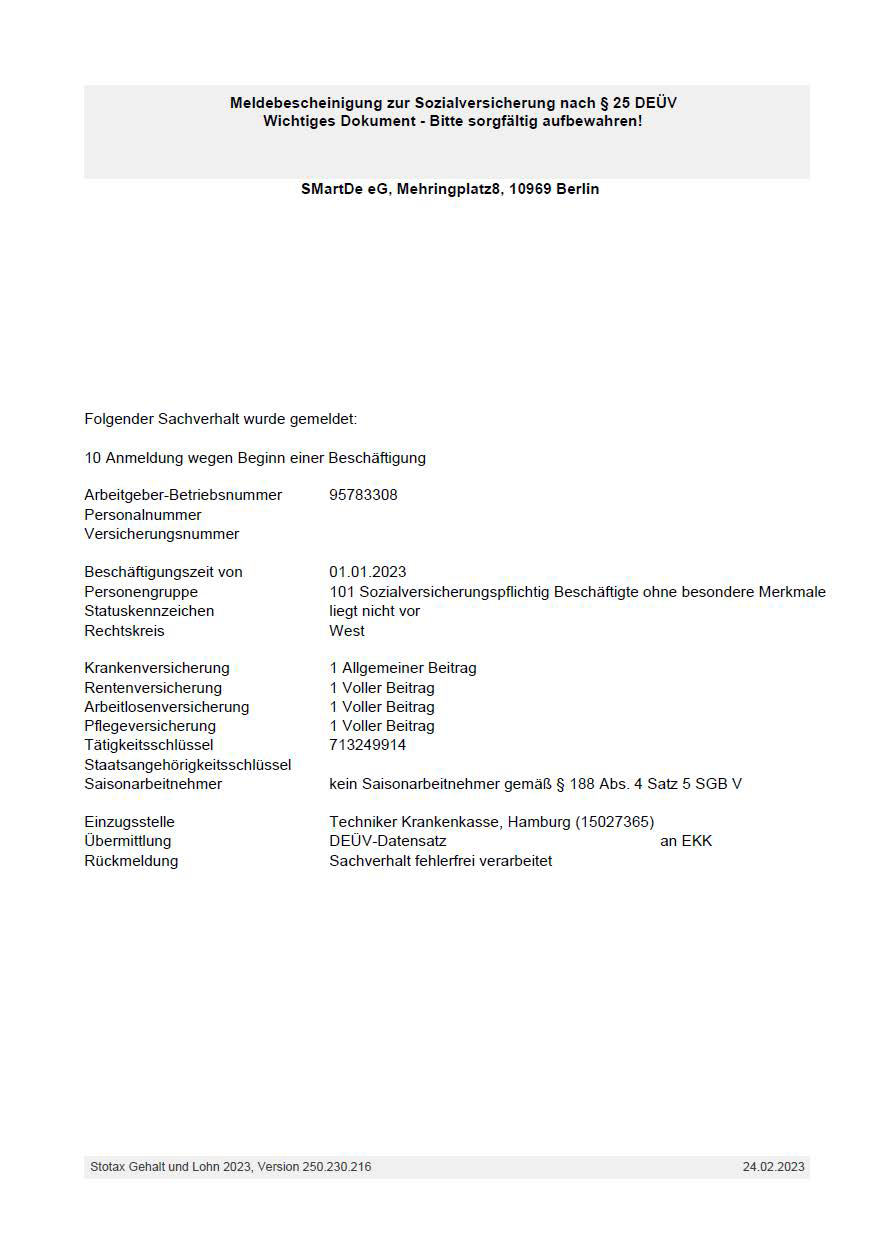

Statements for the social security

Every member employed at Smart with access to social security will receive this official document at the beginning and at the end of employment.

No Comments