Minijobs

For whom?

If your gross salary amounts to up to 538 EUR (info: 2024) you are employed as a minijobber. At Smart that corresponds to the highest Minijob category M10 of 520 EUR. You can find all Minijob categories for each Smart eG and Smart Bildungswerk here.

Please note: Although Minijobbers do not pay contributions to the social security system and have no income tax, there are still flat rate contributions on the side of the employed that will be covered from your budget. Please find the full employment costs in the table with employment categories.

Please note that a mini-job does not give you access to public health insurance. A mini-job can be a good option for you if you already have social security and work with Smart on the side. This applies, for example, to students, people with family insurance or employees.

Minijob checklist

All mini-jobbers must be registered with the mini-job center. You should therefore also complete the mini-job checklist if you are employed by us with a mini-job. We will forward this information to the mini-job center.

You can find the checklist in German and English as well as attachments below:

Minijob checklist (DE)

Minijob checklist (EN)

Pension contributions

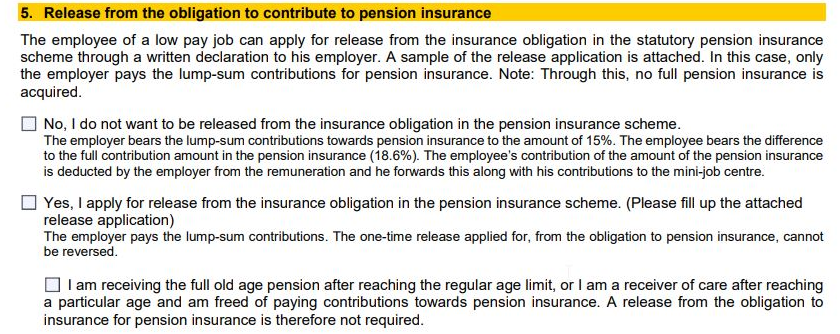

If you are employed as a mini-jobber, you can be exempted from the pension insurance obligation. Under point 5, you should indicate whether you wish to pay pension contributions or not. If you decide not to, you will receive a slightly higher net salary.

If you answer 'yes' to this question, you should also complete the enclosed application for exemption from pension insurance, sign it and send it to Smart.