| #### In a nutshell - Professional cost and travel expenses will be reimbursed from your budget. - Costs can be reimbursed only if they are related to an order processed via Smart or to your activity at Smart. - All professional expenses that you wish to reimburse from your Smart budget must be submitted in the Smart Portal. - Each receipt should be uploaded individually. You can then combine several receipts into one expense reimbursement. We will check the receipts for correctness and reimburse the amount to your account. |

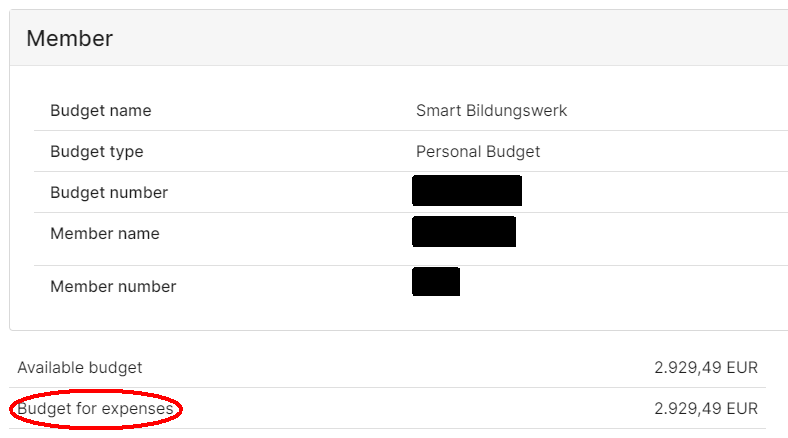

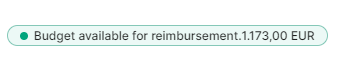

The expense reimbursement form (2) shows your available budget including expenses in the queue that have not yet been transferred. In the budget overview (1), the amount will only be deducted after the expense has been confirmed.

1\) [](https://guide.smartde.coop/en/uploads/images/gallery/2024-06/5V1image.png) 2\) [](https://guide.smartde.coop/en/uploads/images/gallery/2024-06/3Wcimage.png)See also the information under [payment guarantee](https://guide.smartde.coop/en/books/order-processing/page/creating-orders) and [budget](https://guide.smartde.coop/en/shelves/05-budget).

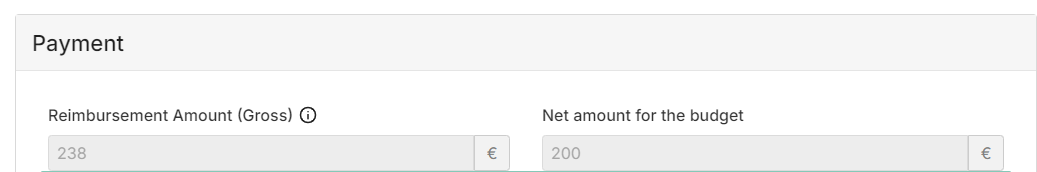

If you submit invoices with the German VAT tax, it can be credited back to your budget.\* That means that you will receive the full reimbursement of the cost (netto + VAT), but only the net invoice amount will be deducted from your budget.

\*This option is not possible for employees of Smart Bildungswerk. Example for invoice amount of 200,00 € netto + 38,00 USt. (19%) = 238,00 € **Reimbursement Amount (Gross):** This amount will be transferred to your account. **Net amount for the budget**: This amount will be deducted from your budget. [](https://guide.smartde.coop/en/uploads/images/gallery/2024-10/image.png) #### Receipts - Only receipts with a date after the start and during your employment at Smart can be accepted. - Receipts **from €250** gross must include the Smart address (also hospitality receipts): SMartDe eG, Wilhelmstrasse 150, 10963 Berlin or Smart Bildungswerk, Wilhelmstrasse 150, 10963 Berlin**We do not accept invoices with your private address**. You can submit a receipt for less than €250 without any address (in which case it is officially not an invoice but a receipt). You can see what a correct invoice should look like [here](https://guide.smartde.coop/en/books/expense-reimbursement/page/receipts-and-invoices).

- All receipts from abroad must include Smart's address and VAT number (reverse charge without VAT shown): VAT ID Smart eG: **DE302421357** VAT ID Smart BW: **DE328477094** - Paper receipts are not accepted. Please only upload legible copies or scans in pdf format directly in the form. Important: only one receipt per file.**Tip: How can you convert photos into PDFs?** 1. right-click on the image -> select 'Print' -> under Printer 'Save as Adobe PDF' 2. Alternatively, you can use free conversion programs on the Internet or apps on your cell phone that convert the photo directly into a PDF (e.g. Genius Scan).