ABC of employment

All questions and answers relating to employment

- Delegation abroad

- Maternity protection

- Minijobs

- Parental Leave

- Payroll

- Sick leave

- Side income

- Unemployment benefits

- Vacation

Delegation abroad

If you bill an order via Smart and carry out this order wholly or partly outside Germany, you must inform Smart at least 10 days before the start of your stay abroad. This also applies to working from abroad (home office/"workation").

Please complete the delegation abroad form. Our payroll team will then take care of applying for the A1 certificate and submitting it to your health insurance provider. You'll find the A1 certificate in your Mein Smart folder.

For temporary work assignments carried out as part of your employment with Smart in the EU, the EEA states (Iceland, Norway, Liechtenstein), Switzerland or the United Kingdom, Smart is required to post you and apply for the A1 certificate prior to the start of the assignment. The A1 certificate may be checked by authorities abroad.

The A1 certificate confirms that you are subject to social security in Germany and that the country in which you are temporarily working may not deduct additional social security contributions from your salary.

If you work regularly at the same location, an A1 certificate with a longer validity period can be issued; however, it can only be valid for the duration of your Smart employment contract.

The posting procedure is not possible for the following cases:

- Non-EU nationals working temporarily in Switzerland, Denmark, the United Kingdom or the EEA states of Iceland, Norway or Liechtenstein

- Nationals of Iceland, Norway or Liechtenstein working temporarily in Switzerland

- Swiss nationals working temporarily in the EEA states of Iceland, Norway or Liechtenstein

If you plan to work for a limited period in a country outside the EU, Switzerland or the EEA, that country may have concluded a social security agreement with Germany. In such cases, Smart may also be able to post you, allowing you to avoid double social security contributions. Please contact us if this applies to your situation.

Maternity protection

What is Maternity Protection?

Maternity protection is a special safeguard for women who are employed and are either pregnant or breastfeeding. It provides protection for both mothers and children, both before and after birth. Maternity protection includes, among other things:

- health protection in the workplace,

- special protection against dismissal,

- a work ban during the weeks before and after birth, and

- income security during the period when work is prohibited.

How long does maternity protection last before and after birth?

Maternity protection begins 6 weeks before the estimated due date and usually ends 8 weeks after the birth.

If your child is born before the expected due date, the maternity protection period still lasts a total of 14 weeks. Therefore, it does not end 8 weeks after birth but a few days later—exactly the number of days by which your child arrived earlier than the due date.

Am I allowed to work during maternity protection?

Before birth, you may continue to work if you wish. Please send us a written confirmation in which you waive the 6-week maternity protection period.

However, the maternity protection weeks after the due date are mandatory, and during this time, Smart cannot issue invoices on your behalf. You will continue to receive your full salary for these two months, and no budget will be deducted.

Required Documents

- Confirmation of waiver of maternity protection (if you wish to work before the birth),

- Medical certificate of the estimated due date (you will receive this approximately 3 months before the birth),

- Application for parental leave starting from the end of maternity protection (please request it via members@smartde.coop)

- Birth certificate or copy of the mother’s passport with the birth date.

Minijobs

For whom?

At Smart the highest Minijob category M13 corresponds to a salary of 603 EUR. You can find all Minijob categories for each Smart cooperative and Smart Bildungswerk here.

Please note: Although Minijobbers do not pay contributions to the social security system and have no income tax, there are still flat rate contributions on the side of the employed that will be covered from your budget. Please find the full employment costs in the table with employment categories.

Please note that a mini-job does not give you access to public health insurance. A mini-job can be a good option for you if you already have social security and work with Smart on the side. This applies, for example, to students, people with family insurance or employees.

Pension contributions

If you are employed as a mini-jobber, you can decide if you want to be into the pension fund as an employee, or not. If you chose to be be exempted from the pension insurance obligation, you have to fill out an exemption request. You'll find the document in the Smart Portal, when requesting a minijob.

How are pension contributions calculated on the employee and employer side?

The minimum pension insurance contribution is 32.55 EUR in total. The employer's share (i.e. the difference between your gross salary and the employment costs) is 15%.

Example: For a salary of EUR 100, the employer's contribution is 15 EUR. The remainder (17.55 EUR) is then deducted from the employee's gross salary. With a salary of EUR 165, the employer's contribution is 24.75 EUR, while the employee's contribution is then only 7.80 EUR.

Parental Leave

What is Parental Leave?

Parental leave is an unpaid break from work for mothers and fathers who want to personally care for and raise their child. As an employee, you can request parental leave from Smart. During parental leave, Smart must grant you up to 3 years off work per child. During this time, you do not need to work and will not receive a salary. As compensation, you can, for example, apply for parental allowance.

Good to Know:

- Each parent can take parental leave.

- You do not necessarily have to apply for parental allowance to take parental leave.

- Parental leave allows you to reduce your work hours to 0% while remaining health insured.

- You can take up to 3 years of parental leave per child.

Please note that during parental leave, you may not be employed at all, or at most 30 hours per week (part-time during parental leave).

Parental Leave and Smart

The key information:

- For health insurance (and other social insurances), no money is deducted from your budget.

- During parental leave, you CANNOT process assignments and will not receive a salary. You can only do this if you work part-time.

- If you decide to work part-time and receive parental allowance (Elterngeld Plus), your assignments should not exceed your employment/allowance ratio. For example, if you have a part-time contract of EUR 1200 net per month and receive EUR 520 Parental Allowance Plus per month, you should not invoice more than approximately EUR 2200 per month through Smart.

- You can, for instance, plan three parental leave periods with a 0 EUR salary and include phases in between in which you pay yourself a salary (from existing/accumulated budget). For this, we need exact information about the amounts of your assignments.

Applying for Parental Leave

Please inform us via email that you would like to go on parental leave. We will send you the application for parental leave by email. Please register your parental leave in good time: at least 7 weeks before the start of parental leave.

Payroll

If you are employed via Smart, you will receive an automatically generated payslip ("Lohnzettel", "Lohnbeleg") at the beginning of the following month, which is uploaded to the Mein.Smart portal. The payslip summarizes all the information about your employment.

The payslip is an important document and official proof of your income. You will receive it every month per e-mail and additionally you can find it in your Mein.Smart account.

Payslip

On the payslip there are only the employee's shares (50%) visible. If you are employed via Smart, you must also pay the employer's share (the other 50%) from your budget. However, this is not listed on the payslip. You can see the full costs in your budget, and an orientation in the employment categories table.

The social insurance line summarizes the employee shares for health, long-term care, pension and unemployment insurance.

The respective shares are broken down again separately in the box at the bottom left:

LSt = wage tax

SoliZ = solidarity surcharge

KiSt = church tax

Kammer = Chamber contribution (only for certain professional groups and for employees of the Bildungswerk)

SV = social insurance

SV-Brutto = the amount that forms the basis for the assessment of social security contributions

KV = health insurance contribution + additional health insurance contribution

RV = the contribution to pension insurance

AV = the contribution to unemployment insurance

PV = the contribution to long-term care insurance (insured persons with children pay 3.05 %, insured persons without children pay 3.05 + 0.35 = 3.4 %)

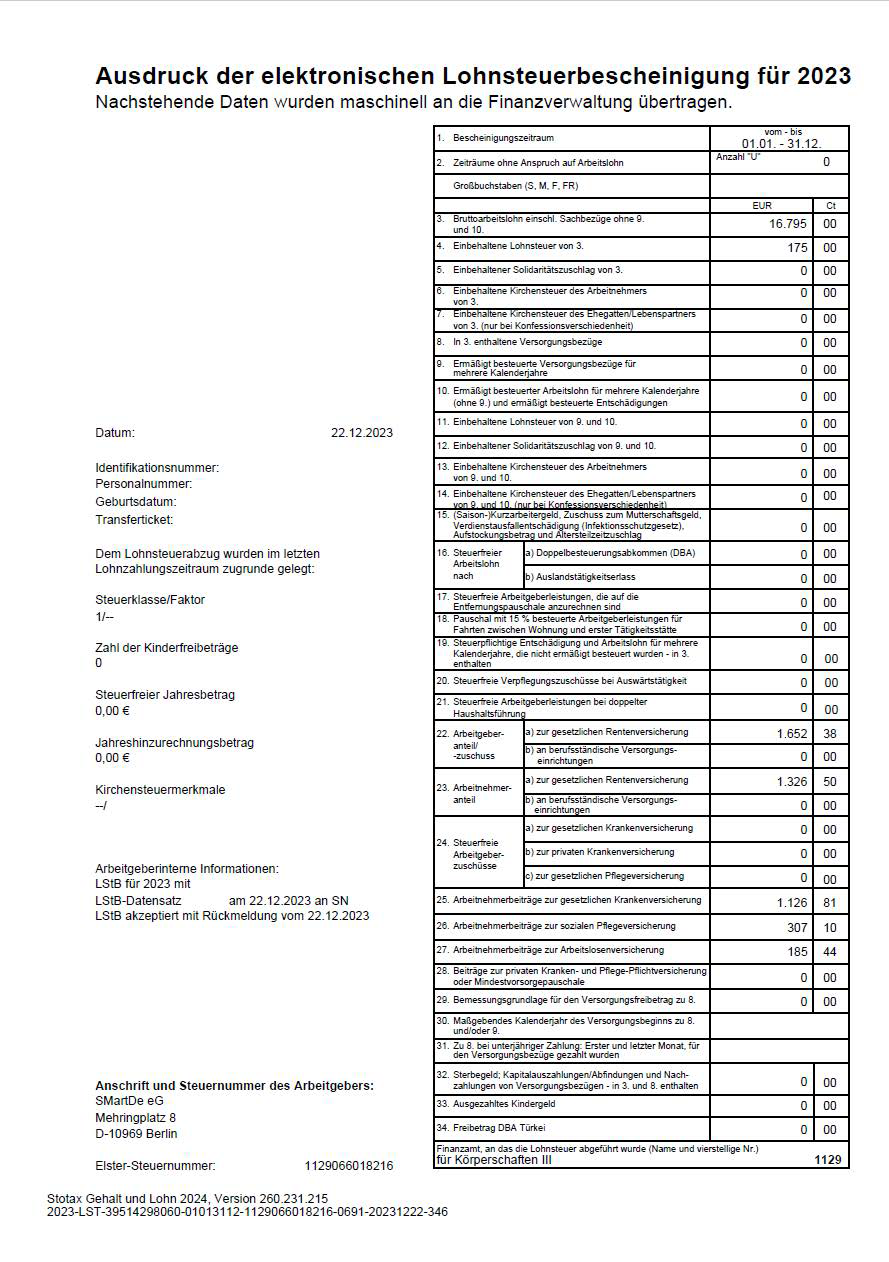

Income tax statement

The Lohnsteuerbescheinigung is an income tax certificate that you receive for a full calendar year. It shows all contributions that you have paid that year. You will find this document in you Mein.Smart as well at the beginning of the following year. You might need this document for your tax declaration.

Please note that there is no income tax certificate issued for employees on a social-security free Minijob.

Statements for the social security

Every member employed at Smart with access to social security will receive this official document at the beginning and at the end of employment.

Sick leave

Sickness notifications are now sent electronically from the doctor to the health insurance company. Nevertheless, we ask you to send us your sickness notifications with start and end date by email, because we do not receive the information automatically from the health insurance. To receive a reliable confirmation we need to insert the exact time frame that matches the information given by the health insurance provider in the system.

Please note that we cannot send invoices for the service period in which you were on sick leave.

Sick pay at Smart eG

If you are employed by Smart eG and fall ill:

- you will continue to receive your salary without interruption.

- for the first 6 weeks, your salary will be paid from your budget. From the seventh week of illness, your health insurance provider (Krankenkasse) will pay sick pay (approx. 70% of your gross salary)

Sick pay at Smart Bildungswerk

The employees of Smart Bildungswerk pay the so-called Umlage 1 (between one and three percent depending on the health insurance company) to the health insurance companies through their employer's contribution and are therefore entitled to continued payment of wages in the form of sick pay from the first week of incapacity for work in the event of illness. The salary is therefore paid by the health insurance provider from the first week, in the case of the eG only from the seventh week of illness. If you, as an employee of the Bildungswerk, are unable to work due to illness and are therefore unable to carry out assignments, you should send us a scan of the medical certificate (for the employer) by e-mail.

Child sickness allowance

If your child is ill, please send us and the health insurance provider the sick note. For this period, the salary will be taken over by the health insurance provider and then paid directly to you (see employment contract § 6: (3) Claims in accordance with § 616 BGB for continued payment of remuneration in the event of temporary incapacity are excluded).

Side income

Own invoicing

If you have your own tax number, you can invoice part of your services yourself in addition to your employment at Smart.

Annual Income Comparison

To remain insured through Smart, it’s important that the majority of your orders are handled through the cooperative. We recommend a ratio of at least 60/40. All your income will be assessed on an annual basis, comparing your average gross salary at Smart with your annual profit from independent work.

If this ratio is not maintained, your status may change, and you may be classified as primarily self-employed, making you responsible for your own health insurance. In this case, you may also be required to pay backdated contributions as a voluntary insured person (freiwillige gesetzliche Versicherung).

Working Hours

Not only your income level but also your working hours can impact your insurance status. You can refer to the employment category table to check how many work hours correspond to your contract. We recommend a contract with at least 20 hours per week if you are also invoicing independently.

Your health insurer may contact you to ask about your working hours and expected earnings from self-employment. If you receive a letter in this context and have questions, feel free to contact Smart.

The final decision regarding your insurance status lies with the health insurance provider.

If you only invoice a portion of your services using your own tax number, you may still be able to benefit from the small business regulation. The income limit for small businesses is specified in § 19 of the German VAT Act (UStG). More information in German can be found here.

Additional Employment

You can have multiple jobs simultaneously. Please contact us in case you take up a new employment, so we can provide optimal guidance.

Depending on your salary with us and with another employer, your tax class may change. If you earn more than 538 euros gross in both jobs, one job will be taxed under tax class 6.

Combining a main job (from 560 euros gross) and a Minijob (up to 556 euros gross) does not affect the tax class.

Please always inform us if you take on additional employment. It’s important for us to know the gross income of other jobs, not only because of the tax class but also for calculating the taxes that we remit on your behalf.

Unemployment benefits

Do you receive unemployment benefits (ALG I) and want to work with Smart?

Processing your orders via Smart is also possible to a limited extent if you are receiving unemployment benefit at the same time. However, the rules regarding permitted additional income must be taken into account. If you regularly work more than 15 hours a week, you can no longer receive unemployment benefits. Agentur für Arbeit has summarized important information in a leaflet.

At Smart, you can earn EUR 165 from a mini-job without having your ALG1 reduced, or EUR 100 if you receive Bürgergeld.

Do you have an order that exceeds the maximum allowed amount? Then you can deregister from the Agentur für Arbeit for the duration of the execution of the project and be employed by Smart with a higher salary for this period. It is also possible that you will still receive unemployment benefit, but your social benefit will be reduced. You always have to inform Agentur für Arbeit about any additional income.

If you receive unemployment benefits at the same time, your budget must always be paid out accordingly, i.e. you are not allowed to 'bunker' your budget and bill higher, but only have a mini-job paid out to you.

You should inform us as soon as you receive ALG I or Bürgergeld. We can then arrange a consultation if necessary.

Your employment with Smart is ending and you want to apply for unemployment benefits (ALG I)?

If you have been employed for 12 months in the last 5 years, you can apply for unemployment benefits (ALG I).

Unemployment registration is not automatic after your contract ends. You should register in person at the Arbeitsagentur 3 months before the end of your employment. See the website of the Arbeitsagentur for more information.

After you end your employment with Smart and register as unemployed, we will send the certificate of employment to the employment agency.

Please always actively inform us that you need the certificate of employment (Arbeitsbescheinigung).

Vacation

Vacation days

All our members are contractually entitled to 20 days' vacation (based on a 5-day week). This corresponds to a statutory regulation on minimum vacation entitlement, which employees are obliged to take.

As a member of Smart, you can organize your working hours flexibly. It is also important to understand that you are responsible for covering all of your employment costs (i.e. your salary during your vacation is also paid from your budget).

To ensure that you have fully used your vacation, two vacation days per month are automatically allocated to you and noted on your payslip.

You can notify us of additional vacation days at any time. As an employer, we can grant you more vacation days. You can apply for a leave in the portal by requesting a change.

Unpaid leave

You can also apply for unpaid leave. This way you can keep your employment uninterrupted without spending money from your budget. If you have no budget for further employment, Smart can suggest unpaid leave.

During unpaid leave, your employment will continue, but you will not receive a salary. No social security contributions will be paid from your budget during this time.

You are still insured during the first month of unpaid leave, but you do not pay pension insurance contributions for that month. For unemployment insurance, periods of unpaid leave do not reduce ALG 1.

However, from the 2nd month of unpaid leave, insurance in all branches of social security ends!